What Is a 50-Year Mortgage?

The introduction of a 50-year mortgage has been talked about recently in the news. This would stretch your loan payments over five decades instead of the usual 30 years. This can make monthly payments smaller—but it comes with trade-offs.

Pros:

- Lower monthly payments may make buying a home more affordable today.

Cons:

- You’ll pay more in interest over the life of the loan.

- It takes longer to build equity in your home.

- Loans over 30 years aren’t backed by Fannie Mae or Freddie Mac, which may mean fewer protections and stricter requirements.

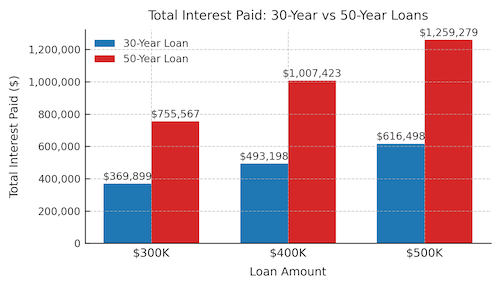

Tip: While 50-year mortgages haven’t been introduced yet, it’s useful to understand the implications of this hot topic. Comparing a 30-year vs. 50-year mortgage in this simple chart can help you see the total interest difference at a glance.

Graphic Source: Housingwire

Building Equity Takes Time

With a longer-term loan, it takes longer to own your home outright. That means:

- You may accumulate less equity in the short term.

- Passing down home equity to future generations could take longer.

Even though 50-year mortgages aren’t available yet, thinking through the pros and cons now can help you make informed decisions when they eventually arrive.

Waiting for Lower Rates: Is It Worth It?

Many buyers are hoping rates drop from the low 6% range into the 5% range. But waiting for that small decrease could actually cost you.

Here’s why:

- Rates peaked above 7% earlier this year, and they’ve already declined.

- On a $400,000 loan, a drop from 6% to 5.99% would save only about $80 per month—not a huge difference.

- Waiting could delay your move and limit your options in a market with motivated sellers.

Tip: Acting now can help you lock in a home before more buyers enter the market, which could push prices up and offset small savings from slightly lower rates.

Key Takeaways for Homebuyers

- Longer-term mortgages can reduce monthly payments but increase total interest and slow equity growth.

- Waiting for tiny rate drops could cost you more than buying now.

- Understanding both the short-term and long-term impact of your mortgage choice is essential for financial confidence.

- While 50-year mortgages aren’t here yet, it’s smart to understand both sides of the conversation so you’re prepared when new options appear.

Buying a home is a balance between what you can afford today and what makes sense for your future. Knowledge is your best tool—so review your options carefully and act with confidence.