Buyers Guide

Everything you need to know about buying a home.

A sound

Decision

Investing in a home is one of the most important decisions you’ll make. So much more than a roof over your head, your home is where life unfolds and memories are made, all while building a financial foundation for your future.

Deciding how you’ll navigate your journey to homeownership is equally critical to the agent you work with. As someone who’s been in your spot before, I’m familiar with what’s cycling through your mind, and as a real estate agent, I’ve mastered the ins and outs of the buying process. When you work with me, you’ll benefit from my experience, and together we’ll work toward making sound, smart decisions for your future.

Your Needs Come First

Your needs drive how and when we find your next home. From this day forward, everything I do will be motivated by your goals and how you imagine your life taking place in your new home. Once I get an understanding of where you see yourself, finding your dream home will move quickly, and with minimal interruption to your daily life.

Getting to know

The Neighborhood

Your neighborhood is an extension of your home. Neighbors, surroundings, and access to everyday things can and should factor into your decision. Based on what you’ve shared so far, I pulled realtime stats and insights to compare a few areas. Once we narrow down the neighborhoods you’re most interested in, I’ll send you information on homes that look like a good fit.

Always remember that you can search, save, and organize your favorites on my site.

Map Your Move

WHEN IS THE BEST TIME TO BUY?

There’s only one right answer:

When you find a home that you love.

Inventory and economy will wax and wane, but when you find a house you can see yourself in, the timing is just right. Below, take a comparative look at neighborhoods with inventory that fits your preferences.

How Buying

A Home Works

1Partner With an Agent

- Absorb their local market stats

- Get to know neighborhood inventory levels

- See what’s about to hit the market

- Gain access to off-market properties

- Review market averages

- Complete needs assessment

2GET PRE-APPROVED FOR A LOAN

- Understand what you can afford

- Determine your monthly mortgage payment

- Understand your debt ratio

- Prepare for escrow

- Obtain a pre-approval letter

3Find your new home

- Compare home and neighborhood averages, then narrow down the neighborhoods you want to live in

- Favorite homes and save them to collections

- Nix homes that don’t meet the mark

- Schedule home tours and plan an itinerary with your agent

- Decide on your dream home

4MAKE YOUR OFFER AND NEGOTIATE THE TERMS

- Review contract terms and time limit for offer

- Negotiate purchase price

- Choose a title company

- Shop home insurance options

- Prepare for down payment, earnest money

- Choose a target closing date

- Sign the offer

- Deliver escrow check

- Stay in close contact with your agent

5UNDER CONTRACT

- Secure a home loan *more details to follow

- Request a list of what conveys with the property

- Schedule home inspection and negotiate repairs

- Acquire a property disclosure from the seller

- Neutralize any contingencies (input any contingencies that may be specific to your area)

- Choose your title company

- Acquire home insurance and send proof to your lender.

- Schedule your closing

- Solidify both contract effective date and allowable move-in dates

- Certify funds for closing

- Stay in close contact with your agent, lender, and title company

6Before you close

- Transfer funds for closing

- Reserve a moving company and set a moving date

- Change your address through USPS, your bank, and other instances

- Set up your utilities to be activated or transferred

- Confirm that all contingencies are resolved

- Schedule the final property walk-through

- Designate a safe, dedicated space to save your final paperwork

- Stay in close contact with your agent, lender, and title company

7CLOSING DAY: WHAT TO BRING

- Connect with your lender to wire down payment funds. You’ll need to cover the cost of closing and the down payment. Bring a printed confirmation of your wire transfer

- Government-issued photo ID(s)

- Social Security numbers

- Home addresses from the last 10 years Proof of homeowner’s insurance

- Proof of homeowner’s insurance

- Your copy of the contract

- Your checkbook

8Closing day

- Sign closing disclosure, promissory note, and all other documentation

- Title transfer

- Deed delivery

- Save your paperwork in your pre-designated spot

My Competitive

Advantage

INDUSTRY INSIDER

Facilitator, negotiator, teacher, cheerleader, confidant – a good agent wears all the hats. In my years with Keller Williams, honing these skills has helped me develop relationships of value. With an inside look at pre-market properties, you’ll have exclusive access to opportunities before they become public knowledge. If they match your preferences, I’ll contact you ASAP.

LOCAL EXPERT

I’ve become something of an area expert. Aside from knowing this market inside and out, being involved in the community has shown me what makes it unique. The personalities and the places, the new and the established, the good and that which-has-seen-better-days – all feed my local knowledge and will help you when decision time comes.

TECH-ENABLED

Based on customer and agent feedback gathered from all over the world, we developed a suite of leading edge, customer-centric tools that work in your favor, complementing your experience for faster, best-in-class results. With a massive amount of data at my fingertips, I’m able to foresee even the smallest microtrend coming down the pike, giving you the full story before you proceed.

How Much Are Closing

Costs for Home Buyers?

If you’re a first-time home buyer, you may not realize that your down payment isn’t the only money you’ll have to come up with when you buy a home. At the close of the sale of your new home, when you sit down to sign all the necessary documents, you’ll need to pay several fees, also known as “settlement” or “closing” costs.

Who Pays Closing Costs

You may be wondering if home buyers are solely responsible for paying closing costs. In fact, when it comes to who pays closing costs in a real estate transaction, the buyer and seller typically have separate fees. As the buyer, however, you may be able to negotiate to have the seller pay some of these fees. Ask your real estate agent for guidance.

What Are Buyer Closing Costs?

These costs are above and beyond the purchase price of your home and can include loan fees, property taxes, insurance premiums, inspection reports, home warranty, and more. Buyer closing costs can vary depending on several factors, including the price of your home, the area where you live (or are moving to), your lender, and the type of loan you get. In some regions and certain cases, you can negotiate for the seller to pay some of the costs.

A closing cost calculator can also be a helpful tool to use when you’re asking, how much are closing costs going to be? This type of calculator can give you estimated costs based on the area where you will be buying a home. The quickest way to find this tool is to search online, but most mortgage websites will also have a free closing cost calculator you can use

The best estimate for closing costs, however, will likely come from your lender. When you apply for a loan, the lender is required by law to provide you with a loan estimate that lists the estimated closing costs. This loan estimate, also called a “Good Faith Estimate,” will list the loan terms and estimated costs, and also show what fees you can and cannot shop for. For example, you can choose the title company but you cannot select the appraiser (your lender chooses the appraiser).

Just before the close of the sale, the lender is required to give you a form that discloses the actual closing costs so that you can compare the original estimated costs. This way you can see if anything has changed or if a new fee has been added.

Here are the typical buyer closing costs:

Loan Costs

If you have less money to use as a down payment, there are various government loan programs, such as FHA, VA, and USDA, that also have their own associated fees. You can shop around for the best loan to suit your finances and goals.

Here are some of the typical fees you will pay for a conventional (non-government) mortgage loan:

- Application fee – A fee that a lender may charge to process your mortgage application.

- Credit report fee – The fee charged by a lender to obtain your credit score.

- Home appraisal fee – A fee for an independent appraiser to assess the value of the property you are buying. The appraiser is usually chosen by the lender.

- Points (discount points) – Fees you can pay upfront to get a lower interest rate on your loan.

- Underwriting or origination fee – A fee the lender charges for evaluating your loan application to determine if you’ll be able to repay the loan.

- Private mortgage insurance – If you have a conventional loan and put down less than 20% of the price of your home as a down payment, your lender will require you to have private mortgage insurance (PMI). This protects the lender against a default on the loan. When you reach 20% equity on your home loan, this insurance is no longer required.

FHA Loan Fees

- Upfront mortgage insurance premium (UFMIP) – This insurance premium fee is required for FHA loans and is paid at closing.

- Annual mortgage insurance premium (MIP) – This is an ongoing insurance premium that you will pay for your FHA loan.

Insurance Costs

When you buy a home, there are different types of insurance your lender may require as well as other insurance you should buy.

Title Insurance

There are two types of title insurance policies: one for the lender and one for the owner (buyer).

- Lender’s title insurance policy

Your lender will require you to purchase a title insurance policy to protect their interest in the property until your loan is paid or you refinance. - Owner’s title insurance policy

The owner’s policy is optional but is strongly recommended as it protects your ownership rights for as long as you own the home.

Homeowners Insurance

Homeowners insurance protects your home and personal property from damages due to fire, storms, and severe weather, as well as vandalism, accidents, and more.

Your lender will require proof of homeowners insurance before they will fund your loan. Many lenders will also require you to prepay the first year of homeowners insurance at the closing. After that, your homeowners insurance is often part of a mortgage escrow account.

Mortgage Insurance

If your down payment on a conventional loan is less than 20%, your lender will require private mortgage insurance (PMI). If you get an FHA loan, you will pay different mortgage insurance premiums, one at close (UFMIP) and one annually (MIP), that are just for FHA loans.

Taxes and Other Costs

Property Taxes

Your property taxes are based on your home’s value and the tax rate set by your county or city. Property tax is often paid annually or semi-annually, so what you owe at closing will vary depending on when the taxes were paid or are due. Going forward, your property taxes are often part of a mortgage escrow account.

Recording Fees

These fees are paid to your local government agency, typically the county, for registering the sale of your home. The recording of the sale then becomes part of the public record. Depending on local government requirements, you may also pay fees for recording your deed and your mortgage.

Closing, Settlement, or Escrow Fee

This fee is paid to the person who handles the closing process, such as a title or escrow company, or if your state requires it, an attorney. In many parts of the country, this fee is part of the title services.

Attorney Fees

In many states, especially in the south and on the east coast, you are required to hire a real estate attorney when buying a home. In the west, escrow or title agents usually handle the closing process (see Closing, Settlement, or Escrow Fee).

Pest inspection

Some regions and government-issued loans require a pest inspection when you buy a home. This fee covers the inspection of your home for pests such as termites, as well as damage from pests, including dry rot.

Home Inspection

While not required by lenders, a thorough home inspection is an essential part of the purchase process. You get to choose a professional inspector to examine your home. The inspector will provide you with a detailed report that includes the age and condition of your home’s systems and appliances and will let you know if anything needs needed maintenance or repairs.

Home Warranty

A home warranty for home buyers offers protection for many home appliances and systems. Unlike homeowners insurance, which covers damages or losses that hopefully will never happen (such as fire, theft, or storm damage), a home warranty protects systems and major appliances that will fail over time—often unexpectedly. As a home buyer, you get access to special home warranty coverage and pricing just for buyers—plus, you can add this valuable protection for up to 60 days after closing. It’s easy to get a quick quote for a home buyer’s warranty in your area.

source: First American Home Warranty

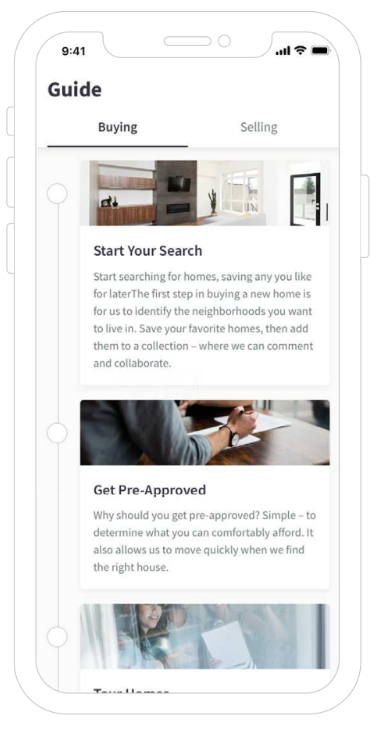

My App:

Finding your Way Home Has Never Been Simpler

GUIDE

When middle-of-the-night questions come up or you want real-time information about the status of your transaction, Guide gives you the tools to anticipate and act on every step of the buying process. Paired with my expertise, you’ll have everything you need to light your way home.

SEARCH

Find your dream home in whatever way works best for you. Whether by neighborhood, school district, ZIP code, and more, my app has the tools to flex with your needs, even when your search extends nationally.

NEIGHBORHOODS

Get real-time stats on specific communities and go deeper to see what makes them tick. From the locals’ favorite coffee shop to the book club that meets once a week, you’ll get an idea of what it’s like to actually live there..

COLLECTIONS

Your search results will be filled with homes you want to save … and some you’d rather forget. My app lets you “favorite” the homes you love and hide the ones you don’t Create Collections to organize your favorites so you can share and find them with ease and discuss with whomever you please.

My app makes achieving your homeownership goals more accessible than ever before. So much more than search, its industryleading feature set and rich insights will prepare you to handle (and enjoy) the entire journey. Get to know my favorite features before you take it for a spin.

Your Trusted Partner

From the day you partner with me, and even past the day you step foot in your new home, consider me your dedicated real estate adviser. Whatever you need, I have the resources and expertise to guide your decisions. Throughout your transaction, you can come to me for both the little things and the important steps, like comprehensive home insurance and competitive financing – I have the inside edge on both.

After your purchase, ask me to recommend fully-vetted service specialists or about how you can care for your home. Further down the road, should you ever want to sell, I’ll be your trusted point person. You’ll always have my number, and I’ll always be ready to spring into action; just say the word!

The

Bottom Line

That’s where I come in.

At the closing table, my goal is for you to feel that the purchase of your home exceeded all of your expectations, so throughout our interactions – from search to close – I’ll work hard to achieve that goal.

When you choose me as your partner, you are not just getting a trusted, respected agent – you are getting a local expert who is passionate about serving our community and those who call it home.

Let’s get started.